Municipal Tax HorusDM.com.br Data Breach: 2M Brazilian Records Exposed

➤Summary

Municipal tax data breach incidents are becoming one of the most critical cybersecurity threats facing public administrations, and the latest case involving HorusDM.com.br highlights just how severe the impact can be. In January 2026, a massive Brazilian municipal tax database was allegedly leaked on BreachForums, exposing nearly two million taxpayer records tied to fiscal declarations, NFSe invoices, and sensitive identification data. This municipal tax data breach does not only affect government infrastructure but also millions of businesses and individuals whose financial and personal information may now be circulating on underground forums 🌐. Understanding what happened, what data was compromised, and what it means for cybersecurity, compliance, and modern risk management is essential for organizations, analysts, and citizens alike.

What Happened in the HorusDM Municipal Tax Incident

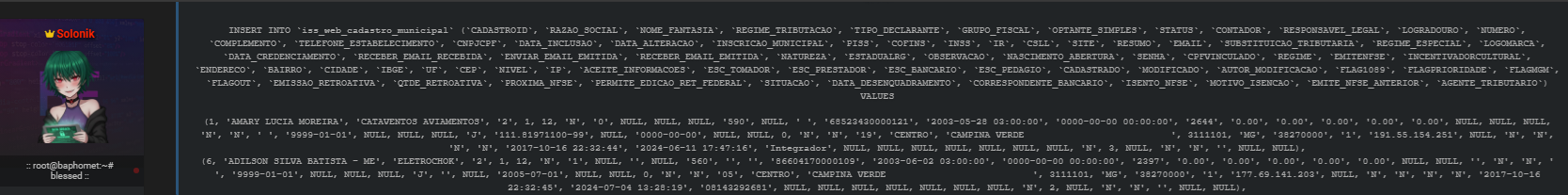

The breach was first published on BreachForums.bf on 13 January 2026 by a user known as “Solonik.” According to the forum post, the compromised system belongs to horusdm.com.br, a platform associated with municipal tax management and NFSe (Electronic Service Invoice) operations in Brazil. The attacker claims access to approximately 1.97 million rows of data across 16 databases, distributed as a SQL dump totaling around 456 MB.

This municipal tax data breach is categorized as a government and fiscal data exposure, raising immediate concerns over public sector cybersecurity and compliance with Brazil’s LGPD data protection law ⚠️.

Scope and Nature of the Compromised Data

The leaked content reportedly includes detailed municipal taxpayer records, fiscal declarations, invoice logs, and system metadata. Data of this nature is highly sensitive because it directly links legal entities and individuals to tax obligations and financial behavior. In a municipal tax data breach of this scale, even partial datasets can enable fraud, impersonation, and targeted phishing campaigns. The exposure also highlights how interconnected local tax systems are with national financial oversight structures 💼.

Translated Overview of Compromised Database Fields

To better understand the depth of the exposure, the leaked SQL structure reveals dozens of fields related to taxpayer registration and fiscal status. Below is a translated and simplified overview of key fields originally listed in Portuguese:

- CadastroID: Registration ID

- Razão Social: Legal Company Name

- Nome Fantasia: Trade Name

- Regime Tributação: Tax Regime

- Tipo Declarante: Declarant Type

- Grupo Fiscal: Fiscal Group

- Optante Simples: Simplified Tax Regime Option

- Status: Registration Status

- Contador: Accountant

- Responsável Legal: Legal Representative

- Logradouro, Número, Complemento: Street Address Details

- Telefone Estabelecimento: Business Phone

- CNPJ/CPF: Company or Individual Tax ID

- Data Inclusão / Alteração: Record Creation and Update Dates

- Inscrição Municipal: Municipal Registration Number

- PIS, COFINS, INSS, IR, CSLL: Federal Tax Indicators

- Email and Website: Contact Information

- Natureza: Business Nature

- Nascimento/Abertura: Birth or Company Opening Date

- Senha: Password (if stored insecurely)

- Endereço Completo: Full Address with City, State, ZIP, IBGE Code

- IP: Logged IP Address

- Situação: Fiscal Situation

This level of detail makes the municipal tax data breach particularly dangerous, as it combines identity, location, and fiscal data in a single dataset 📊.

Why Municipal Tax Systems Are High-Value Targets

Municipal tax platforms aggregate vast amounts of sensitive information, often across multiple departments and years. Attackers target these systems because a single breach can yield millions of records with verified financial data. In Brazil, NFSe systems are especially attractive due to their integration with service providers, banks, and accounting software. A municipal tax data breach can therefore ripple across ecosystems, affecting suppliers, contractors, and even consumers 💡.

Risks for Businesses and Individuals

What does this mean for those whose data may be included? The risks are both immediate and long-term. Fraudsters can use leaked taxpayer IDs and invoice histories to craft convincing social engineering attacks. Businesses may face reputational damage or fraudulent tax filings, while individuals could be exposed to identity theft. This Brazil tax database leak also increases the likelihood of credential stuffing if passwords or weak hashes are present. In short, the municipal tax data breach creates a broad attack surface that extends well beyond the original system 🔐.

Compliance and Legal Implications in Brazil

Brazil’s General Data Protection Law (LGPD) requires public and private entities to implement adequate security controls and to notify authorities and affected individuals in case of data exposure. A breach involving municipal taxpayer records raises questions about accountability, incident response, and transparency. Regulatory scrutiny may follow, particularly if evidence shows insufficient safeguards or delayed disclosure.

How This Breach Was Distributed

According to the forum post, the dataset was shared as a structured SQL dump, making it easy for other actors to import and analyze the information. SQL dumps are especially dangerous because they preserve relational links between tables, allowing full reconstruction of taxpayer profiles. This method of distribution is common in large-scale government system leaks and accelerates secondary misuse of the data 🚨.

Practical Checklist: How to Respond to a Municipal Data Leak

If you are an organization, analyst, or affected entity, consider the following practical steps:

- Monitor underground forums and leak indexes for mentions of your organization or identifiers.

- Enforce immediate password resets and review authentication logs.

- Audit stored tax and invoice data for unnecessary retention.

- Notify legal and compliance teams to assess LGPD obligations.

- Educate employees and clients about phishing risks linked to tax data.

This checklist can significantly reduce secondary damage after a municipal tax data breach ✅.

Expert Insight on Government Data Security

Cybersecurity analysts frequently warn that public sector systems lag behind private enterprises in security investment. As one Latin American cybersecurity researcher noted, “Local government databases often combine legacy software with modern web interfaces, creating complex attack surfaces that are hard to defend.” This observation aligns closely with what we see in the HorusDM incident and other Brazil tax database leak cases 🧠.

Where to Track Similar Breaches and Threat Intelligence

For readers seeking ongoing updates on leaks, breaches, and underground activity, dark web monitoring platforms provide searchable indexes of forum disclosures and datasets. Reviewing historical cases can help contextualize the HorusDM breach within broader trends affecting government and fiscal systems. Additional insights and breach monitoring resources are also available through internal guides on darknetsearch.com, which analyze threat actors and exposed databases.

Key Takeaways from the HorusDM Case

This municipal tax data breach demonstrates how vulnerable centralized fiscal systems can be when security controls fail. The exposure of nearly two million records underscores the need for stronger encryption, access control, and continuous monitoring in government IT environments. It also reminds businesses and citizens that tax data is not just administrative information but a valuable digital asset that requires protection 🔎.

Conclusion and Call to Action

The HorusDM.com.br incident is a clear example of the growing risks facing municipal tax infrastructures in Brazil and beyond. A single municipal tax data breach can compromise financial stability, trust, and legal compliance on a massive scale. Staying informed and proactive is no longer optional in today’s threat landscape. Discover much more in our complete guide. Request a demo NOW.

Your data might already be exposed. Most companies find out too late. Let ’s change that. Trusted by 100+ security teams.

🚀Ask for a demo NOW →Q: What is dark web monitoring?

A: Dark web monitoring is the process of tracking your organization’s data on hidden networks to detect leaked or stolen information such as passwords, credentials, or sensitive files shared by cybercriminals.

Q: How does dark web monitoring work?

A: Dark web monitoring works by scanning hidden sites and forums in real time to detect mentions of your data, credentials, or company information before cybercriminals can exploit them.

Q: Why use dark web monitoring?

A: Because it alerts you early when your data appears on the dark web, helping prevent breaches, fraud, and reputational damage before they escalate.

Q: Who needs dark web monitoring services?

A: MSSP and any organization that handles sensitive data, valuable assets, or customer information from small businesses to large enterprises benefits from dark web monitoring.

Q: What does it mean if your information is on the dark web?

A: It means your personal or company data has been exposed or stolen and could be used for fraud, identity theft, or unauthorized access immediate action is needed to protect yourself.

Q: What types of data breach information can dark web monitoring detect?

A: Dark web monitoring can detect data breach information such as leaked credentials, email addresses, passwords, database dumps, API keys, source code, financial data, and other sensitive information exposed on underground forums, marketplaces, and paste sites.