Wells Fargo Data Breach 2025 Revealed: 200k Records Exposed

➤Summary

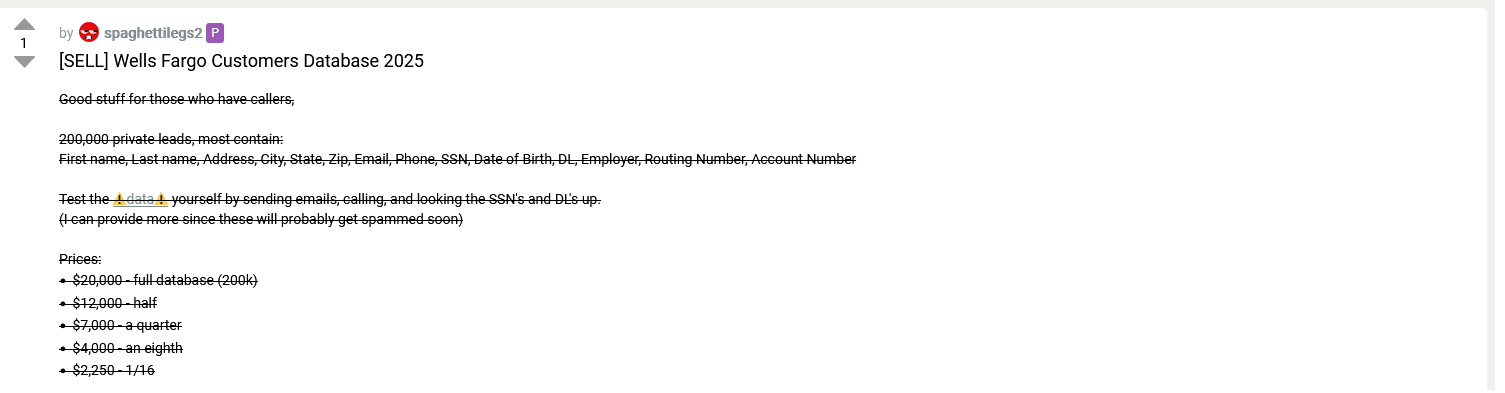

Wells Fargo data breach 2025 is the latest in a growing series of high-profile security incidents shaking the banking industry. On September 29, 2025, a hacker under the alias spaghettilegs2 listed 200,000 Wells Fargo customer records for sale on Dread Forum. The leak was discovered by the Kaduu team during routine monitoring of darknet forums. The stolen database, sold just days later on October 3, has raised urgent concerns about insider threats, customer privacy, and the underground economy of stolen identities. According to the post, the dataset contained extremely sensitive information including SSNs, bank account numbers, and driver’s licenses—making this incident one of the most damaging in recent years. 🔥

The Forum Listing and Sale

The threat actor’s forum post gave a detailed pricing breakdown for the stolen Wells Fargo customers database: – $20,000 – full database (200k records) – $12,000 – half database – $7,000 – quarter database – $4,000 – eighth database – $2,250 – 1/16 database By October 3, 2025, the seller confirmed: “update: whole db has been sold”. This fast transaction demonstrates how highly valued bank customer data remains within cybercriminal markets. 🔒

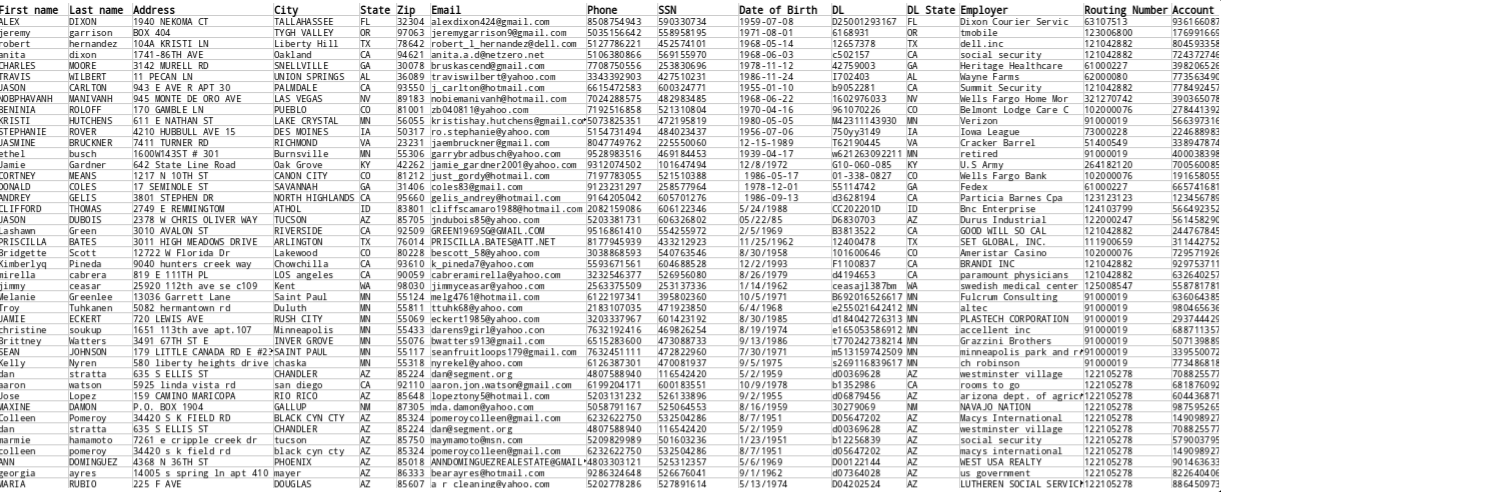

What Information Was Stolen?

The compromised Wells Fargo database contained: – Names and contact details (address, city, state, ZIP, phone, email) – Social Security Numbers (SSNs) – Dates of Birth – Driver’s License data – Employer details – Bank account numbers and routing numbers This combination represents a full identity profile (“fullz”), which criminals exploit for fraud, phishing, and identity theft schemes.

Proof of Forum Post 🧾

Redacted Data Samples 🔎

Wells Fargo’s Response

Wells Fargo acknowledged the data breach on October 2, 2025, confirming that a former employee’s unauthorized access was responsible. The bank stated it has launched an investigation with federal authorities and is notifying affected customers. More official details are covered in this article from Daily Security Review.

Why Insider Threats Are So Dangerous

Unlike traditional cyberattacks, insider breaches come from individuals who already have trusted access. Financial institutions like Wells Fargo must revoke credentials immediately after employment ends, but lapses create opportunities for abuse. Cybersecurity experts note that insider threats are among the hardest to detect and can cause the largest-scale leaks. 🌐

The Darknet Economy and Pricing

Cybercrime forums often list stolen data in structured pricing tiers. In this case, Wells Fargo customer records were priced to appeal both to fraud rings and smaller buyers. However, the bulk sale suggests one serious buyer obtained exclusive control of the dataset. Experts believe such data may later circulate again through resellers. Related studies on darknet activity can be found at DarknetSearch.

Practical Risks for Victims ⚠️

Affected customers now face: – Identity theft (new accounts opened fraudulently) – Bank fraud (ACH transfers, wire fraud) – Phishing and targeted scams – Synthetic identity creation Practical tip: Customers should freeze credit reports, enable 2FA on bank accounts, and monitor all transactions daily.

Security Expert Insight

Dr. A. Morgan, a cybersecurity analyst, notes: “This Wells Fargo breach underscores that financial institutions must prioritize insider risk programs as much as perimeter defenses. Data misuse from within remains the Achilles heel of banking security.”

Practical Checklist for Protection ✅

- Freeze your credit at Equifax, Experian, TransUnion

- Enroll in bank-provided credit monitoring

- Monitor accounts daily for unauthorized charges

- Beware of phishing calls and emails

- Report suspicious activity immediately

Industry Reaction

Financial security analysts agree the Wells Fargo customers database breach is a turning point. It shows the impact of insider risk and how quickly sensitive data moves from theft to monetization. The combination of SSNs, DOBs, and bank account numbers makes this breach particularly dangerous. Related coverage and research are available at DarknetSearch.com.

FAQ: Is my data safe after the Wells Fargo data breach?

If you are a Wells Fargo customer, your information may be at risk. The bank has pledged free credit monitoring, but you should remain vigilant by reviewing accounts and considering a credit freeze. 🛡️

Internal Update

On October 3, 2025, the forum post confirmed: “update: whole db has been sold.” This strongly indicates that the stolen Wells Fargo data is now in the possession of one or more sophisticated fraud groups. Although it may not yet be publicly distributed, history shows these “exclusive” sales eventually resurface across broader underground markets.

Conclusion

The Wells Fargo data breach 2025 is one of the most severe insider-driven leaks in the banking sector, exposing 200,000 highly sensitive records. The rapid sale of the dataset highlights the demand for financial data in the darknet economy and the urgent need for stronger insider threat defenses. Customers must act immediately to secure their personal and financial identities. For the banking industry, this is a wake-up call that trust and access management are as critical as firewalls and intrusion detection. 🔑

👉 Discover much more in our complete guide

👉 Request a demo NOW

Your data might already be exposed. Most companies find out too late. Let ’s change that. Trusted by 100+ security teams.

🚀Ask for a demo NOW →Q: What is dark web monitoring?

A: Dark web monitoring is the process of tracking your organization’s data on hidden networks to detect leaked or stolen information such as passwords, credentials, or sensitive files shared by cybercriminals.

Q: How does dark web monitoring work?

A: Dark web monitoring works by scanning hidden sites and forums in real time to detect mentions of your data, credentials, or company information before cybercriminals can exploit them.

Q: Why use dark web monitoring?

A: Because it alerts you early when your data appears on the dark web, helping prevent breaches, fraud, and reputational damage before they escalate.

Q: Who needs dark web monitoring services?

A: MSSP and any organization that handles sensitive data, valuable assets, or customer information from small businesses to large enterprises benefits from dark web monitoring.

Q: What does it mean if your information is on the dark web?

A: It means your personal or company data has been exposed or stolen and could be used for fraud, identity theft, or unauthorized access immediate action is needed to protect yourself.

Q: What types of data breach information can dark web monitoring detect?

A: Dark web monitoring can detect data breach information such as leaked credentials, email addresses, passwords, database dumps, API keys, source code, financial data, and other sensitive information exposed on underground forums, marketplaces, and paste sites.